Mike Whitney

Information Clearinghouse

November 5, 2007

“It’s scary out there—there’s blood on the streets” anonymous Wall Street trader

Last Wednesday, the Federal Reserve dropped its benchmark interest rate by 25 basis points to 4.5% citing ongoing weakness in the housing sector. As expected, the stock market rallied and the Dow Jones Industrial Average soared 137 points. Unfortunately, Bernanke’s “low interest” stardust wasn’t enough to buoy the markets through the rest of the week.

On Thursday, the hammer fell. The Dow plummeted 362 points in one afternoon on increasing fears of inflation, a slowdown in consumer spending, a steadily weakening dollar and persistent problems in the credit markets. By day’s end, the Fed was forced to dump another $41 into the banking system to forestall a major breakdown. This is the most money the Fed has pumped into the financial system since 9-11 and it shows how dire the situation really is.

Why do the banks need such a massive infusion of credit if they are as “rock solid” as Bernanke says?

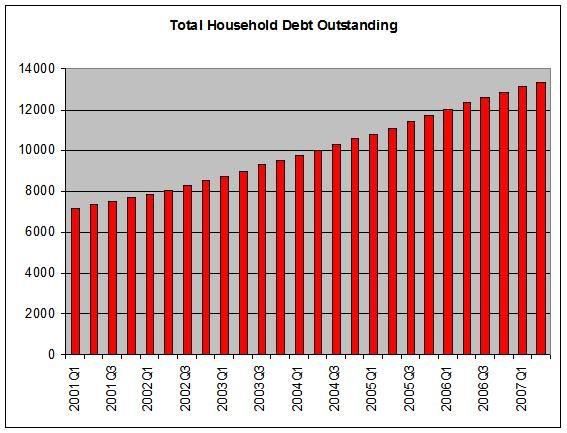

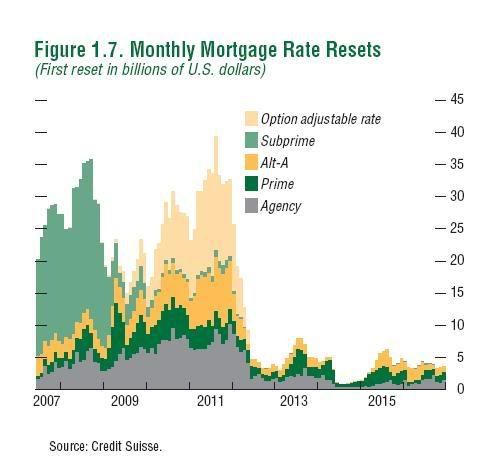

As most people now realize, the mortgage industry is on life-support. Many of the ways that the banks were generating profits have vanished overnight. The “securitization” of debt (mortgages, car loans, credit card debt etc) has ground to a halt. What had been a booming multi-billion dollar per-year business is now a dwindling part of the banks’ revenues. Investors are steering clear of anything even remotely associated to real estate.

Additionally, the banks are holding an estimated $200 billion in mortgage-backed securities and derivatives for which there is currently no market. This is compounded by $350 billion in “off balance sheets” operations—which are collateralized with dodgy long-term mortgage-backed securities—that provide funding for “short-term” asset-backed commercial paper. ASCP has shriveled by $275 billion in the last 10 weeks leaving the banks with gargantuan liabilities. Bernanke was forced to add $41 billion to keep the banking system from slipping beneath the salty brine.

This shows how powerless the Fed really is when it comes to changing the overall direction of the markets. Sure, Bernanke and his buddies in the Plunge Protection Team can goose the market by buying-up futures and boosting the day’s results. But that’s just a short-term fix. In the long run, the Fed has less chance of stopping the market from correcting than it does of stopping a runaway truck by standing in its path. Besides, the Fed cannot purchase the banks bad investments (CDOs, MBSs, or CP) nor can it reflate the multi-trillion dollar the housing bubble. All it can do is provide more cheap credit and hope the problems go away.

So far, the lower rates haven’t even decreased the price of the 30-year mortgage or made refinancing any cheaper. All they’ve done is postpone the inevitable day of reckoning. In truth, they’re just a desperate attempt to perpetuate consumer borrowing while the banks figure out how to offload their enormous debts. That’s what Paulson’s $80 billion “Banker’s Bankruptcy Fund” is really all about; it’s just the repackaging of subprime junk so it can be passed off to credulous investors. Fortunately, the public has “wised up” and isn’t buying into this latest fraud. As a result, the banks have taken another blow to their already-flagging credibility.

In the last two months, the pool of qualified mortgage applicants has contracted, as has the market for massive merger and acquisition deals (private equity). So the banks are probably doing more with the Fed’s $41 billion injection than just beefing up their reserves and issuing new loans. The market analysts at Minyanville.com summed it up like this:

“Banks are taking the liquidity the Fed is forcing out there through the discount window and repos. After using it to shore up the declining value of their assets, they have excess to lend out. Finding no traditional borrowers that want to buy a house or build a factory, the new rules the Fed has set forth allows the banks to pass this liquidity onto their broker dealer subsidiaries in much greater quantities. These broker dealers are lending thus to hedge funds and margin buyers who are speculating in stocks. Remember, the Fed is powerless unless it can find people to borrow the credit it wants them to spend. By definition, the last ones willing to take that credit are the most speculative.”

This is a likely scenario given the fact that the stock market continues to fly-high despite the surge of bad news on everything from the falling dollar to the geopolitical rumblings in the Middle East. Last month, the Fed modified its rules so that the banks could provide resources to their off-balance sheets operations (SIVs and conduits). If the Fed is willing to rubber-stamp that type of monkey-business; then why would they mind if the money was stealthily “back-doored” into the stock market via the hedge funds?This might explain why the hedge funds account for as much as 40 to 50% of all trading on an average day. It also explains why the stock market overheating.

The charade, of course, cannot go on forever. And it won’t. Rate cuts do not address the underlying problem which is bad investments. The debts must be accounted for and written off. Nothing else will do. That doesn’t mean that Bernanke will suddenly decide to stop savaging the dollar or flushing hundreds of billions of dollars down the investment bank toilet. He probably will. But, eventually, the blow-ups in the housing market will destabilize the financial system and send the banks and over-leveraged hedge funds sprawling. Bernanke’s low interest “giveaway” will amount to nothing.

Bloomberg News ran a story last week which shedsmore light on the jam the banks now find themselves in:

“Banks shut out of the market for short-term loans are finding salvation in a government lending program set up to revive housing during the Great Depression.

Countrywide Financial Corp., Washington Mutual Inc., Hudson City Bancorp Inc. and hundreds of other lenders borrowed a record $163 billion from the 12 Federal Home Loan Banks in August and September as interest rates on asset-backed commercial paper rose as high as 5.6 percent. The government-sponsored companies were able to make loans at about 4.9 percent, saving the private banks about $1 billion in annual interest.”

Whoa. So, now that the credit markets have frozen over, the banks are going to the government with begging bowl in hand? So much for “moral hazard”.

Commercial paper is short-term notes that businesses use for daily operations. Because much of this CP is backed by mortgage-backed securities; the banks have been having trouble rolling it over. (Refinancing) So–unbeknownst to the public–various banks have been borrowing from the government-sponsored Federal Home Loan Banks (FHLB) so they can cut their losses (or stay afloat?) The FHLB has extended $163 billion of loans to them, which means that the risks that are inherent in supporting “dodgy banks that make bad bets” has been transferred to FHLB’s investors. The danger, of course, is that—when investors find out that FHLB is mixed up with these shaky banks—they are liable to sell their shares and trigger a collapse of the system. This is a good example of the dim-witted strategies that are being used to bail out the banks. There are probably many similar scams underway just beyond the publics’ view.

Citi’s Woes

Over the weekend, Citigroup’s CEO Chuck Prince got the axe. Citigroup, which boasts more than 300,000 staff worldwide, has lost more than 20% of its market value from bad bets in sub-prime mortgages. According to the Times Online: “The Securities and Exchange Commission may investigate whether it improperly juggled its books to hide the full extent of the problem.”

”Juggled” is not a word that is taken lightly on Wall Street where traders are now bracing for another massive sell-off of financial stocks. Mr. Prince won’t be alone in the unemployment line either. He’ll be accompanied by Merrill Lynch’s former boss, Stanley O’ Neal who got the boot last week when his firm reported $8.4 billion in write-downs. Deutsche Bank analysts now “predict that Merrill may write off another $10 billion of losses related to its portfolio of sub-prime debts”. (Times Online) That would wipe out 8 full quarters of earnings and represent the largest loss in Wall Street history.

The news is bleak, bleak, bleak. The systemic rot is appearing everywhere presaging ongoing losses for the financial giants and a long-downward spiral for the markets. The banks are currently under-regulated, over-leveraged and under capitalized. And now the sh** is about to hit the fan.

Former Fed chief Paul Volcker summarized the overall economic situation last week at the second annual summit of the Stanford Institute for Economic Policy Research. In his speech he said:

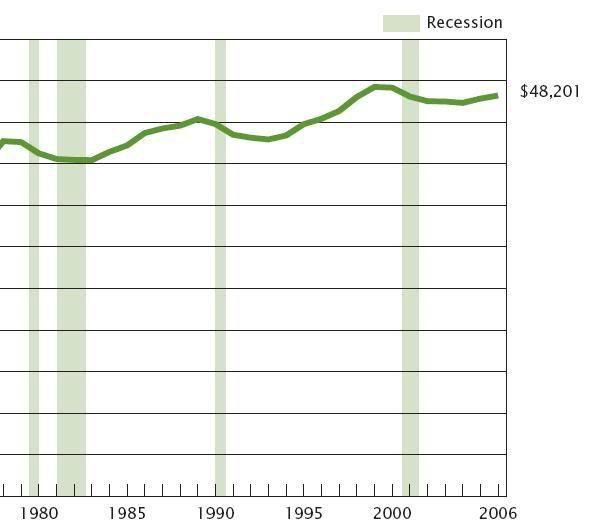

| “Altogether, the circumstances seem as dangerous and intractable as I can remember….Boomers are spending like there is no tomorrow. Homeownership has become a vehicle for borrowing and leveraging as much as a source of financial security….. As a Nation we are consuming…about 6% more than we are producing. What holds it all together? - High consumption - high leverage - government deficits - What holds it all together is a really massive and growing flow of capital from abroad. A flow of capital that today runs to more than $2 Billion per day.” The nation is facing “huge imbalances and risks.” Volcker is right. The country is in a bigger pickle than any time in its 230 year history. The credit storm that was engineered at the Federal Reserve has swept across the planet and is now descending on commercial real estate, credit card debt, and the plummeting bond insurers industry. These are the next shoes to drop and the tremors will be felt throughout the broader economy. |

THE DARK AGES?

As this article is being written, Reuters is reporting that Citigroup may be forced to write-down as much as $11 billion in subprime mortgage-related losses!

Reuters: “Citigroup announced today significant declines since September 30, 2007 in the fair value of the approximately $55 billion in U.S. sub-prime related direct exposures in its Securities and Banking (S&B) business. Citi estimates that, at the present time, the reduction in revenues attributable to these declines ranges from approximately $8 billion to $11 billion (representing a decline of approximately $5 billion to $7 billion in net income on an after-tax basis).”

Citigroup’s statement indicates a willingness on its part to come clean with its investors but, in fact, they know that the situation is fluid and there’ll be hefty losses in the future. Mortgage-backed securities (MBSs) and collateralized debt obligations (CDOs) will continue to be downgraded as time goes by. According to the Financial Times, one banker was having so much difficulty getting a bid on subprime securities; he found the only way he could get rid of them was through “barter. He resorted to using a tactic more normally associated with third world markets than the supposedly sophisticated arena of high finance. ‘Barter is the only thing that works,’ he chuckled, ‘It’s like the Dark Ages’” The article continues:

“Never mind the fact that the risky tranches of subprime-linked debt have fallen 80 per cent since the start of the year; in a sense, such declines are only natural for risky assets in a credit storm. Instead, what is really alarming is that the assets which were supposed to be ultra-safe - namely AAA and AA rated tranches of debt - have collapsed in value by 20% and 50% odd respectively. This is dangerous, given that financial institutions of all stripes have been merrily leveraging up AAA and AA paper in recent years, precisely because it was supposed to be ultra-safe and thus, er, never lose value.” (Financial Times; Gillian Tett)

AAA and AA assets—the top-graded tranches— have already been downgraded by 20% to 50%!?! And the prices are bound to fall even more because there is no market for mortgage-backed securities. This is a banks worst nightmare; an asset that loses value and requires greater capital reserves EVERY DAY. In fact, AAA rated MBSs have dropped 14% in one month. It is truly, death by a thousand cuts.

The US financial system is now buckling beneath the weight of its own excesses. The subprime contagion—which can trace its origins to the massive expansion of credit at the Federal Reserve—has devastated the housing market generating an unprecedented number of foreclosures, record inventory, and a massive multi-trillion dollar equity bubble which is now catastrophically deflating and wiping out much of the mortgage industry in its path. Its effects on the secondary market have been even more devastating where pension funds, insurance companies, hedge funds and foreign banks are left holding hundreds of billions of dollars of complex, mortgage-backed securities and subprime-related derivatives which are now destined to be downgraded to pennies on the dollar ravaging once-robust portfolios. The subprime meltdown has been equally damaging to myriad European investment banks and brokerage houses. We’ve seen a wave of bank closings in France, Germany and England which has left investors shell-shocked; triggering capital flight from American markets and supplanting confidence in the US financial system with growing suspicion and rage. Where are the regulators?

According to Bloomberg News, ”European and Asian investors will avoid most US mortgage-backed securities for years without guarantees from government-linked entities creating an enormous drag on the US housing market” Foreign investors believe they were hoodwinked by bonds that were deliberately mis-rated to maximize profits for the investment banks. This may explain why $882 billion has been diverted into Chinese and Indian stock markets in the last month alone.

The biggest losers of all, however, are the financial giants that created most of the abstruse, debt-instruments that are now devouring the system from within. The productive and “wealth creating” components of the economy have been subordinated to a finance-driven model which suddenly derailed due to the abusive expansion of debt. Inevitably, some of the banks that took the greatest risks will be shuttered and trillions of dollars in market capitalization will disappear. They are the victims of their own scam.

Is it possible that anyone with a pulse and a minimal ability to reason couldn’t see the inherent problems of building a humongous financial edifice on the prospect that millions of first-time homeowners with “a bad credit history and no collateral” would pay off there mortgages in a timely and responsible manner?

No. It is not possible. It was completely crazy…..and foreseeable! The real reason that the subprime swindle mushroomed into a humongous economy-busting monster is that the markets are no longer policed by any agency that believes in intervention. The pervasive “free market” ideology rejects the notion of supervision or oversight, and as a result, the markets have become increasingly opaque and unresponsive to rules that may assure their continued credibility or even their ability to function properly.

The “supply side” avatars of deregulation have transformed the world’s most vital and prosperous markets into a huckster’s street-corner shell-game. All regulatory accountability has vanished along with trillions of dollars in foreign investment. What’s left is a flea-market for dodgy loans, dubious over-leveraged equities and “securitized” Triple A-rated garbage.

Let’s hear it for the Reagan Revolution.

What is striking is how the new “structured finance” paradigm replicates a political system which is no longer guided by principle or integrity. It is not coincidental that the same flag that flies over Guantanamo and Abu Ghraib flutters over Wall Street as well. Nor is it accidental that the same system that peddles bogus, subprime tripe to gullible investors also elevates a “waterboarding advocate” to the highest position in the Justice Department. Both phenomena emerge from the same fetid moral swamp—Bush’s America.

A man in Sweden didn’t like the way his son-in-law was acting, so he sent a note to the FBI accusing the guy of being an Al Qaeda operative just before he took a trip to the USA. When he landed, the DHS held him in a cell for 11 hours, then deported him. Can’t be too safe, dontcha know.

A man in Sweden didn’t like the way his son-in-law was acting, so he sent a note to the FBI accusing the guy of being an Al Qaeda operative just before he took a trip to the USA. When he landed, the DHS held him in a cell for 11 hours, then deported him. Can’t be too safe, dontcha know.

Ron Paul’s presidential campaign received a whopping $4.2 million in donations over 24 hours yesterday, eclipsing any of the other Republican candidates and putting debunkers to shame who had attempted to discredit the campaign by suggesting Paul’s support was imaginary, inflated and exaggerated as a result of Internet spamming.

Ron Paul’s presidential campaign received a whopping $4.2 million in donations over 24 hours yesterday, eclipsing any of the other Republican candidates and putting debunkers to shame who had attempted to discredit the campaign by suggesting Paul’s support was imaginary, inflated and exaggerated as a result of Internet spamming. Despite years of denials, a secret planning document issued by the U.S. military’s nuclear-weapons command in 2003 ordered preparations for nuclear strikes on countries seeking to acquire weapons of mass destruction, including Iran, Saddam Hussein-era Iraq, Libya and Syria.

Despite years of denials, a secret planning document issued by the U.S. military’s nuclear-weapons command in 2003 ordered preparations for nuclear strikes on countries seeking to acquire weapons of mass destruction, including Iran, Saddam Hussein-era Iraq, Libya and Syria.